The Code will document outcomes which are not acceptable and which result in an applicant failing the review process e.g.

- To ensure best practice in the sector and assist in setting the standards for professional compliance.

- To reassure agencies, their end-clients and those engaging the services of Professional Contractors that they are dealing with the most compliant service providers in the business, which means risk is minimized.

- To promote recognition of the value that the professional contractor workforce adds to the Irish economy and ensure an equitable business environment in which the Professional Contractor can operate.

- To become a recognised and trusted voice for the service providers sector and provide a platform for likeminded professionals to share ideas and discuss opportunities.

- Help to set and raise standards relating to tax, employment and regulation in the industry. To be based on both required (minimum) standards and best practice

- Be underpinned by a Code of Ethics and Complaints

- Have broad acceptance amongst key external stakeholders particularly the Revenue Commissioners and clients

- Help clients to understand the quality of service and benefits and make informed assessments when purchasing services

- Have the backing of the industry through support of a newly formed industry association (to be called the PCSO)

- Be capable of being developed further over time

- Indicates how the member operates, supported by independent review

- Being in the best position to remain compliant with tax and employment legislation

- Receive an efficient and effective service

- Clear description of service through sales and marketing materials

- Helps to maintain various company structures as an option for the client

- Helps client market to end user and has benefit to end user (eg MNC)

- PCSO can lobby for own and client interests

- Credibility for industry and members

- Clear understanding of what the PCSO and the industry don’t accept

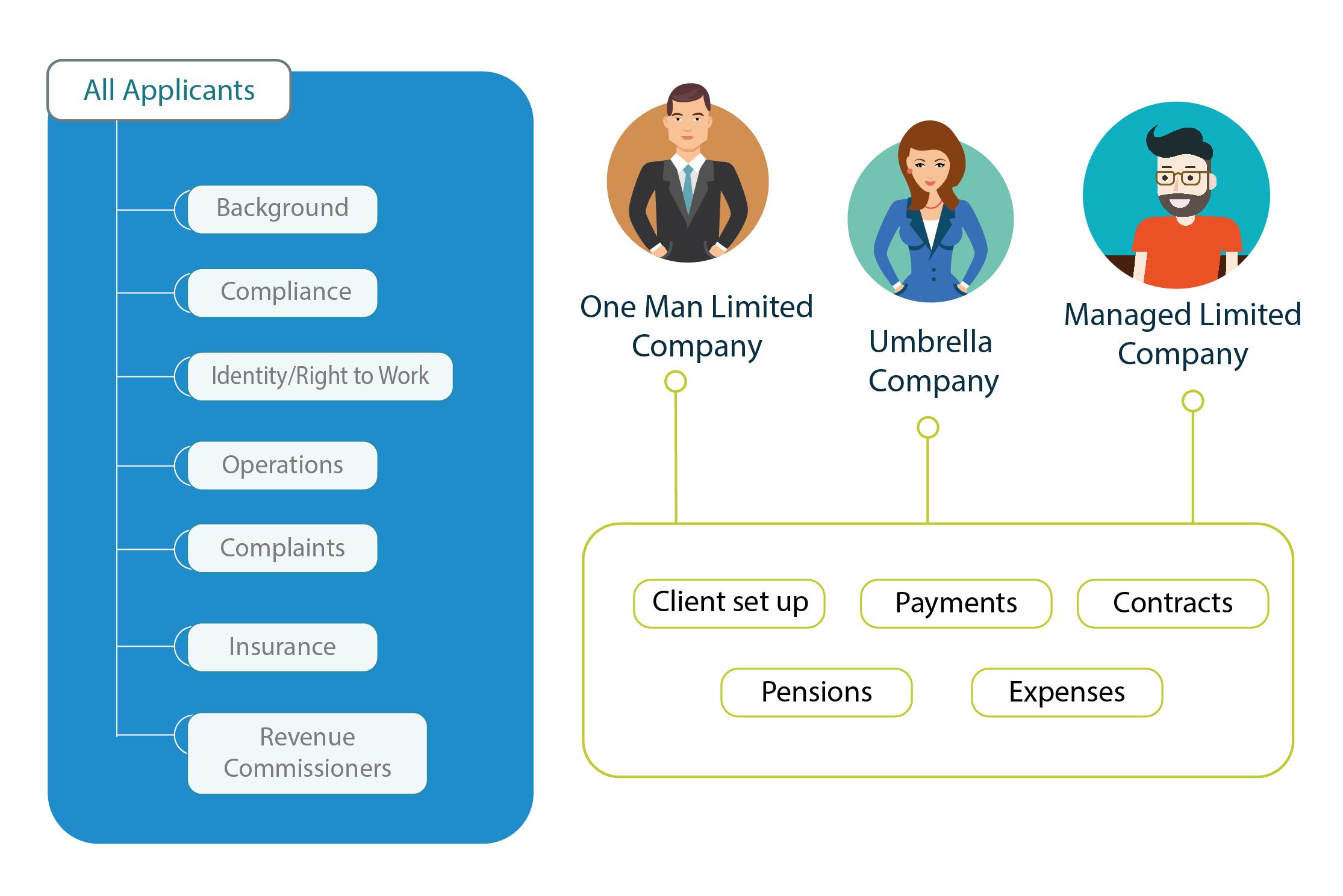

- Companies not established correctly

- Poor contracting arrangements

- Hidden or unclear charges which are not clear at the outset

- Funds being channeled offshore in a non legal manner

- Inflated or unvouched expenses

- Companies that don’t do identity and right to work checks

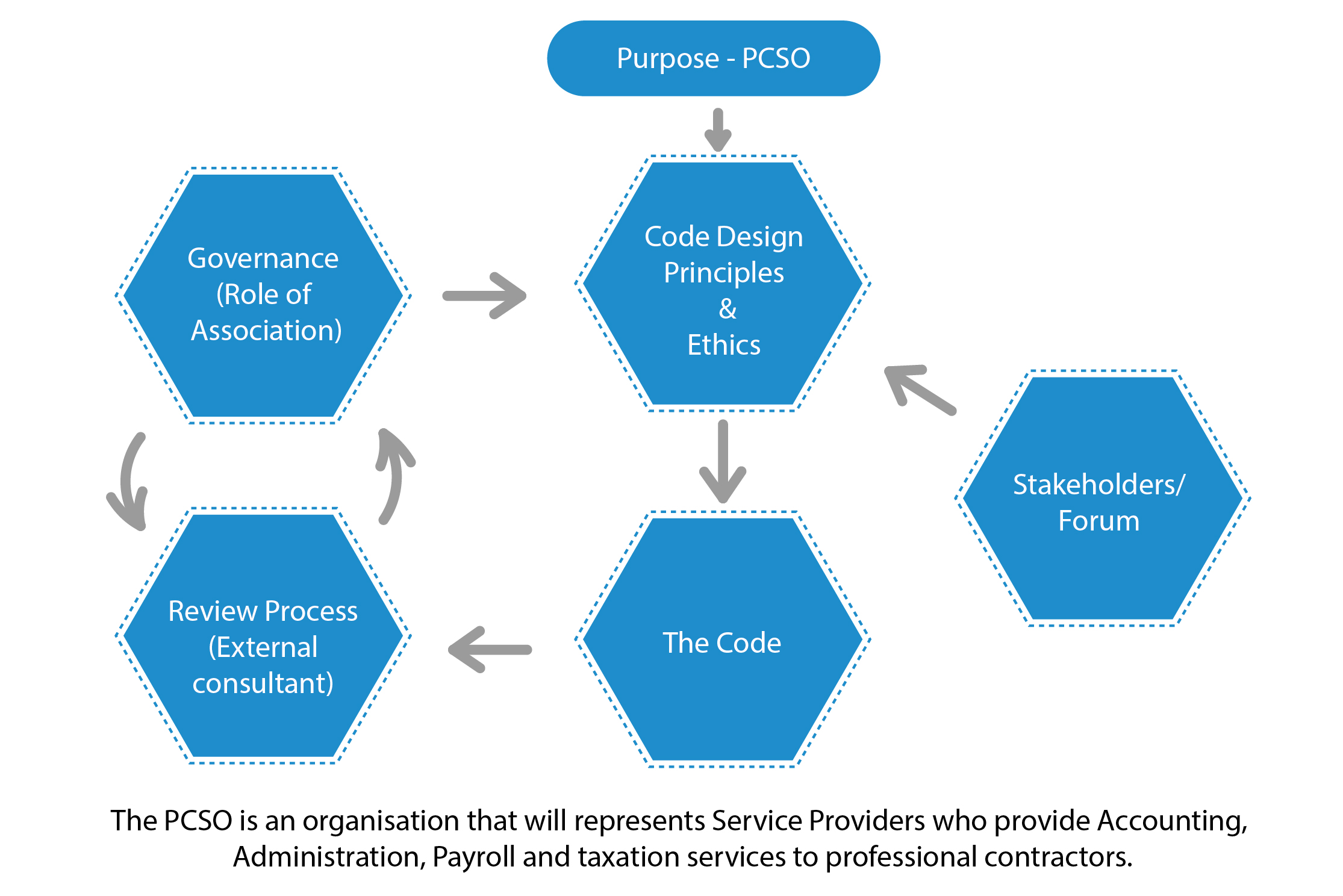

- A Forum Group established to facilitate discussion and interaction with the PCSO in order seek views and to keep the PCSO current.

- Forum will meet on a regular basis.

- The PCSO will seek to have broad support for PCSO and the Code from the wider stakeholder group.